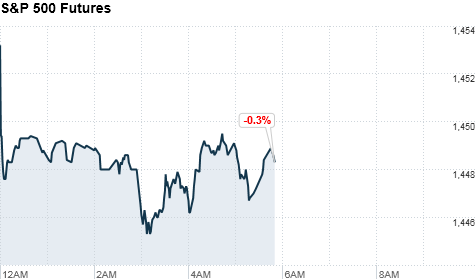

Mortgage rates fell to a record low once again in the latest reading.

NEW YORK (CNNMoney) -- Mortgage rates fell to record low levels once again last week, as the Federal Reserve's decision to buy billions in home loans for the foreseeable future helped bring lending costs down for home buyers and owners.

Mortgage finance backer Freddie Mac's weekly survey of mortgage rates showed the average 30-year fixed-rate mortgage fell to 3.49% from 3.55% the previous week. That matched the previous record low set in July. The fixed-rate 15-year mortgage reached a new record low of 2.77%, down from 2.85% a week earlier.

The Fed announced last Thursday that it would be buying $40 billion in mortgage-backed securities each month for the foreseeable future. The idea of the purchases, popularly know as QE3, is to spur economic activity buy pumping more cash into the economy and driving down rates. Those taking out new home loans, either to purchase or refinance, will be among the first beneficiaries of the Fed's policy.

Keith Gumbinger, vice president of HSH.com, a provider of mortgage information and analysis, said he would expect rates will likely go about 0.2 percentage point lower in the coming weeks as the market reacts to the Fed's mortgage bond purchases.

"I don't think you've seen the full effect of the Fed's influence in the market yet," he said. "I think we'll have to see a slowdown in mortgage applications, working through some of the volume in the pipeline."

The low rates can help the economy even beyond the effect it has on the housing market, by putting more money in the pockets of homeowners who refinance. Someone who bought a house a year ago by borrowing $200,000 at the 4.09% 30-year rate a year ago can still reduce their payments by more than $1,000 a year by refinancing at the current rates. Savings are larger if they borrowed more money or paid higher rates.

Related: Fed policies benefit the wealthy

But the lower rates also allow home buyers to pay more for a home, which many believe has been a factor in the recent turnaround in home prices. Frank Nothaft, chief economist at Freddie Mac, said the lower rates should help the ongoing housing recovery.

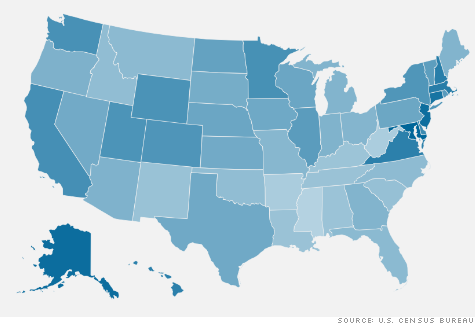

On Wednesday, the National Association of Realtors reported a 7.8% gain in sales of previously owned homes compared to a year earlier, while the Census Bureau reported that housing starts and building permits rose substantially in August. Other readings have reported that home prices are finally turning higher after years of steady decline.

But while the housing market is showing signs of improvement, prices and sales are still hurt by an excess inventory of foreclosed homes and continued jobs market weakness.

Gumbinger said while the lower rates are a positive for the housing market, they are only part of the solution.

"Mortgage rates haven't been the impediment to home sales for quite some time," he said.

Gumbinger said many potential buyers can't qualify for the low rates due to recent foreclosures ruining their credit. And other buyers who might qualify still are reluctant to buy after watching the damage done by falling prices in recent years.

"There's a sizable part of the market that can't be served, or won't be served, by low rates," he said. ![]()

First Published: September 20, 2012: 10:15 AM ET

20 Sep, 2012

-

Source: http://rss.cnn.com/~r/rss/money_latest/~3/zx1UmboonYQ/index.html

--

Manage subscription | Powered by rssforward.com