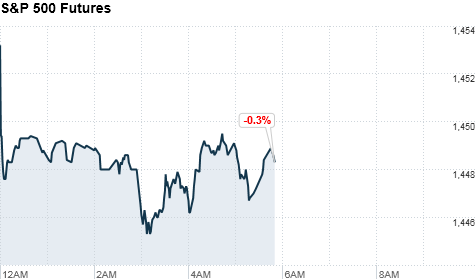

Click on chart for more premarkets data.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a lower open on Thursday, as disappointing reports in Asia and Europe showed signs that business everywhere continues to stall.

Dow Jones industrial average, S&P 500 and Nasdaq futures were down more than 0.2%.

A Chinese manufacturing report by HSBC, a purchasing manager's index, showed that manufacturing in the world's second largest economy ticked up slightly in September but still shrunk. Asian markets responded by closing in the red, with the Shanghai Composite losing 2.1%, the Hang Seng in Hong Kong shedding 1.2% and Japan's Nikkei dropping 1.6%.

It was similar in Europe, where Markit's regional purchasing managers index fell to a 39-month low. It showed the fastest contraction of new business and services in more than three years, and European stocks all dropped in morning trading. Britain's FTSE 100 was down 0.7%, the DAX in Germany dropped 0.5% and France's CAC 40 fell 1%.

Back in the U.S., investors begin Thursday awaiting data on initial jobless claims and a handful of corporate results. They appear fearful of doing much with stocks as they try to get a handle on where the economy is headed.

With the status of the recovery still in doubt, central bankers around the world have been stepping up stimulus efforts.

Last week, the Federal Reserve announced a third round of the asset-purchasing program known as quantitative easing. That came after the European Central Bank revealed its new bond-buying program earlier this month.

On Wednesday, the Bank of Japan also announced that it was expanding its asset-purchasing program.

U.S. stocks closed up slightly on Wednesday.

Related: Fear & Greed Index

Economy: At 8:30 a.m. ET, the Labor Department will release data on initial jobless claims for the week ended September 15, which are expected to total 375,000, according to a survey of analysts by Briefing.com. At 10 a.m., the Philadelphia branch of the Federal Reserve will release its monthly business outlook survey.

Companies: Firms including drugstore chain Rite Aid (RAD, Fortune 500) and investment bank Jefferies (JEF) are due to report their quarterly results on Thursday morning.

Software giant Oracle (ORCL, Fortune 500) is up after the bell. Analysts surveyed by Thomson Reuters expect Oracle to report earnings of 53 cents a share on $8.4 billion in revenue.

Shares of railroad operator Norfolk Southern (NSC, Fortune 500) sank in after-hours trading Wednesday after the company lowered its third-quarter guidance. Fellow rail transport firms CSX (CSX, Fortune 500), Union Pacific (UNP, Fortune 500)and Kansas City Southern (KSU) also fell on the news.

Shares of Bed Bath & Beyond (BBBY, Fortune 500) dropped in after-hours trading Wednesday after the retailer missed earnings estimates.

Online real estate site Trulia announced Wednesday evening that it had priced its initial public offering at $17 a share. The company will begin trading on the New York Stock Exchange Thursday under the symbol "TRLA."

Currencies and commodities: The dollar rose against the euro and British pound, but it fell versus the Japanese yen.

Oil for October delivery fell 89 cents to $91.09 a barrel.

Gold futures for December delivery fell $9.30 to $1,762.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.73% from 1.78% late Wednesday. ![]()

First Published: September 20, 2012: 6:20 AM ET

20 Sep, 2012

-

Source: http://rss.cnn.com/~r/rss/money_latest/~3/oaH78LQxyt8/index.html

--

Manage subscription | Powered by rssforward.com

Anda sedang membaca artikel tentang

Stocks: Set for lower open on global slowdown

Dengan url

http://facingtrial.blogspot.com/2012/09/stocks-set-for-lower-open-on-global.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Set for lower open on global slowdown

namun jangan lupa untuk meletakkan link

Stocks: Set for lower open on global slowdown

sebagai sumbernya

0 komentar:

Posting Komentar